Fleet managers prized these trucks for their strong pulling power and greater reliability than vehicles powered by early, fitful internal combustion engines (ICEs). And now, in a high-tech second act, both incumbent and nontraditional makers of commercial vehicles across most weight categories and a variety of segments are launching new “eTrucks.” A century on, the question is, why now?

We believe the time for this technology is ripe and that three drivers will support the eTruck market through 2030. First, based on total cost of ownership (TCO), these trucks could be on par with diesels and alternative powertrains in the relative near term. Second, robust electric-vehicle (EV) technology and infrastructure is becoming increasingly cost competitive and available. Third, adoption is being enabled by the regulatory environment, including country-level emission regulations (for example, potential carbon dioxide fleet targets) and local access policies (for example, emission-free zones). At the same time, barriers to eTruck adoption exist: new vehicles must be proved to be reliable, consumers need to be educated, and employees, dealers, and customers will require training. Furthermore, there are challenges in managing the new supply chain and setting up the production of new vehicles.

Based on the analysis of many different scenarios—which are highly sensitive to a defined set of assumptions—our research shows that commercial-vehicle (CV) electrification will be driven at different rates across segments, depending on the specific characteristics of use cases.

Electrification is happening fast, and it’s happening now

McKinsey developed a granular assessment of battery-electric commercial vehicles (BECVs) for 27 CV segments across three different regions (China, Europe, and the United States), three weight classes, and three applications. The three weight classes are light-duty trucks (LDTs), medium-duty trucks (MDTs), and heavy-duty trucks (HDTs), while the three applications are urban, regional, and long-haul cycles. While our modeling also includes other alternative fuels and technologies such as mild hybrids, plug-in hybrids (PHEVs), natural gas, and fuel-cell electric CVs, this article focuses on full electrification.

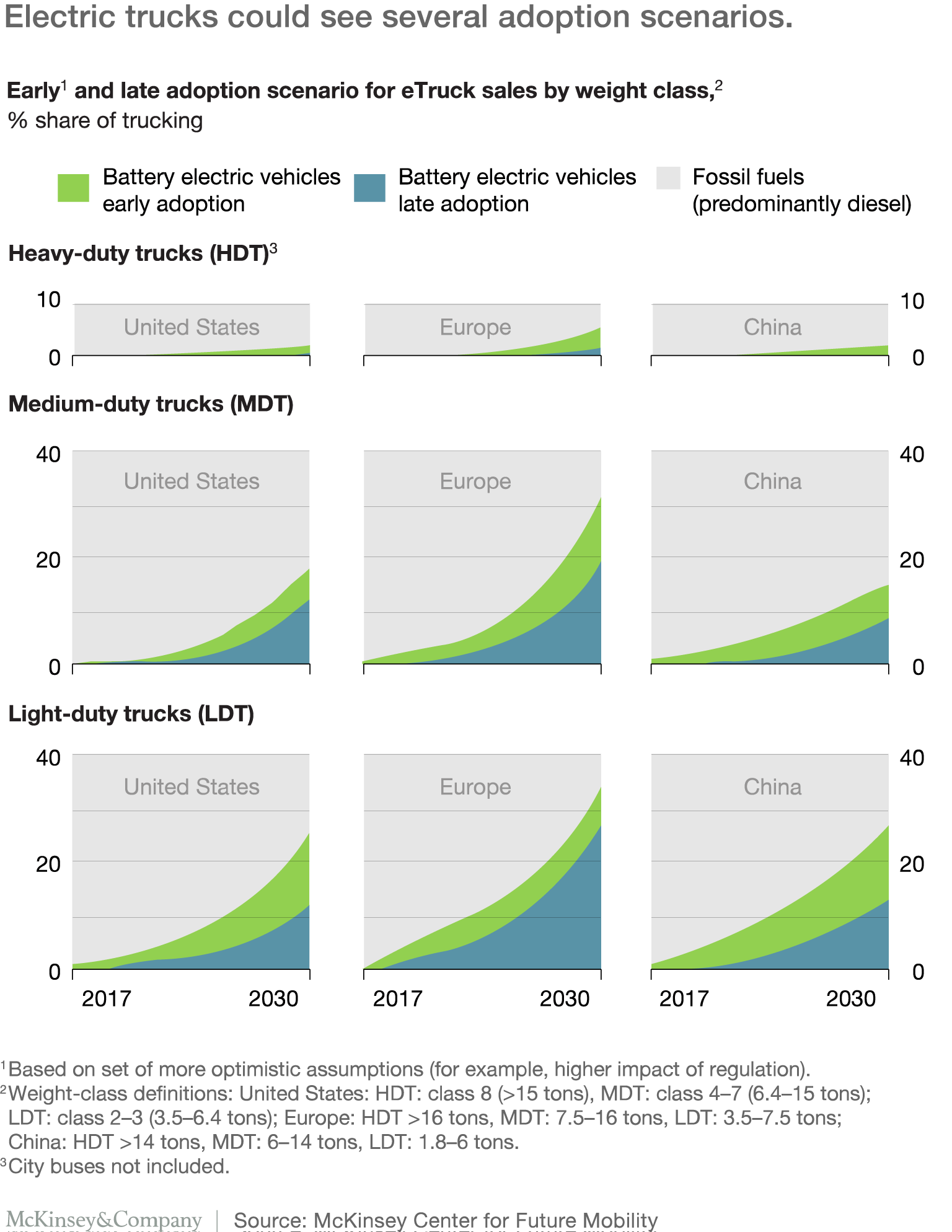

Our model concentrates on two scenarios, “early adoption” and “late adoption,” to help place bookends for each weight class and geography (Exhibit 1). The two scenarios reflect different beliefs regarding core assumptions, such as the effectiveness of any regulatory push, the timing of infrastructure readiness, and the supply availability, which results in delay or advancement of uptake.

Our research reveals strong potential uptake of BECVs, especially in the light- and medium-duty segments. Unlike decision criteria to purchase passenger cars, CV purchasing decisions place greater emphasis on economic calculations and reflect a greater sensitivity to regulation. Light- and medium-duty BECV segment adoption will probably lag that of passenger-car EVs through 2025 due to a lack of eTruck model availability and fleets that are risk averse. However, our analysis indicates that in an “early adoption” scenario, BECV share in light and medium duty could surpass car EV sales mix in some markets by 2030 due to undeniable TCO advantages for BECVs over diesel trucks.

Comparing the weight classes, our scenarios suggest low uptake in the HDT segment mainly because of high battery costs, and, as such, later TCO parity. In the MDT and LDT segments, our “late adoption” scenario suggests that BECVs could reach 8 to 27 percent sales penetration by 2030, depending on region and application. In our “early-adoption” scenario, with more aggressive assumptions about the expansion of low-emission zones in major cities, BECVs could reach 15 to 34 percent sales penetration by 2030.

The inflection point appears to be shortly after 2025, when demand could be supported by a significant tailwind from the expected tightening of regulation (for example, free-emission zones), in combination with increasing customer confidence, established charging infrastructure, model availability, and improved economics for a variety of use cases and applications.

The importance of total cost of ownership

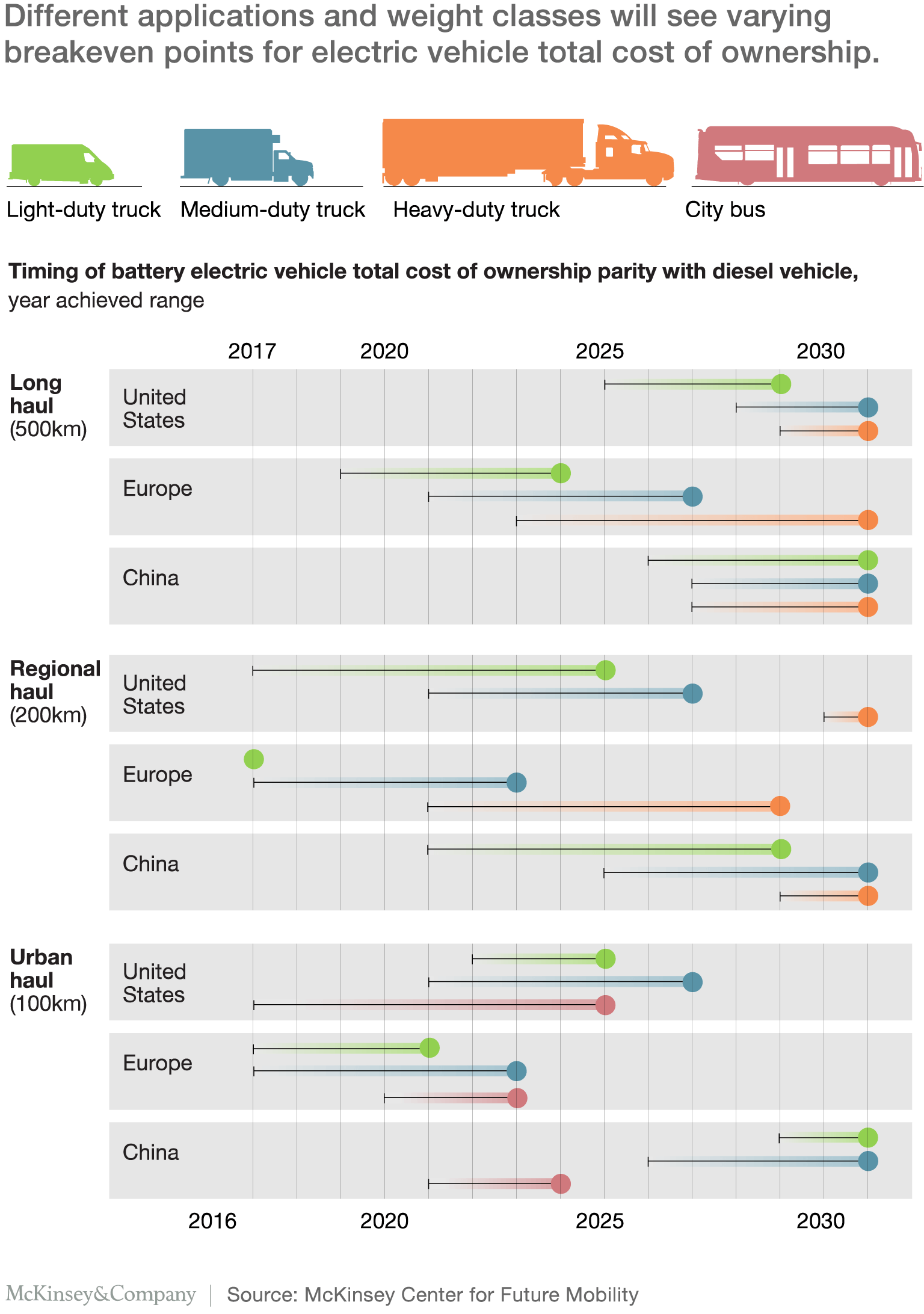

TCO plays a more important role in commercial-vehicle purchasing considerations and modeling TCO helps companies understand the timing of TCO parity across different powertrain types. We analyzed the sensitivity of TCO parity to see how much earlier a specific use case with a custom-made technology package tailored to a predefined driving and charging pattern can break even. The illustration of the “race of eTrucks” shows the interval of potential TCO breakeven points for various applications and weight classes (Exhibit 2). The light-colored shade behind each point indicates how early a specific use case can potentially break even.

Medium average daily distances show the earliest TCO breakeven point. Looking across weight classes, we can identify an optimal daily driving distance that establishes TCO parity for eTrucks and diesels. In the example shown, the earliest breakeven point occurs at a distance travelled of about 200 kilometers a day. This sweet spot of operation means the battery is large enough to enable efficient operation without too many recharges, while ensuring sufficient annual distance to benefit from the lower cost per kilometer. At the same time, the battery is still small enough to limit upfront capital expenditures. This effect is strongest where the difference between electricity and diesel prices is high, as in the European Union, where taxes on fuels are high, resulting in a high price differential with electricity prices. In the United States, prices for fuel and electricity are both lower, as is the absolute price differential.

Urban city buses will break even earliest in the heavy-duty segment. Electric city buses—an adaptation of a purpose-built HDT—could break even the earliest in the HDT segment, between 2023 and 2025 for the average application. In China in 2016, the share of new EV bus sales already exceeded 30 percent1 due to regulatory considerations. By 2030, EV city buses could reach about 50 percent if municipalities enact conducive policies. City and urban bus segments are likely to experience some of the highest BECV penetration levels in Europe and the United States.

The breakeven point for light-duty urban applications is sensitive to minor changes in use case. While the average LDT-segment truck could break even in 2021, by slightly modifying the use-case characteristics (for example, using a smaller battery, recharging during operation, or assuming higher energy efficiency due to disabled heating for urban parcel delivery), the case can reach parity today.

Three critical assumptions most affect TCO breakeven points. The assumptions that drive TCO uncertainties include the development of fuel and electricity efficiencies for ICE or BECV technologies, the cost of batteries, and the cost of fuel and electricity. Also, our analysis shows that the TCO breakeven of urban applications is more sensitive to changes in assumptions than it is for long-haul applications. That’s because the costs per kilometer associated with both BECVs and ICEs for long hauls remain closer to each other for a longer period. For example, a five percent improvement in a BECV’s TCO would shift the breakeven point by three to four years in urban applications, but only by about two years in long-haul applications.

Infrastructure readiness

The required charging infrastructure represents a major challenge to BECV uptake. Nevertheless, charging may not be as critical as it is for passenger cars, due to the predictability and repeatability of driving patterns and operational uses and the central nature of refueling. In general, charging infrastructure will be required at depots to enable charging when BECVs are not in use (for example, overnight). Building a supporting infrastructure will require investments by vehicle owners and, potentially, end users as well. (Our TCO modeling reflects the required cost of use-case-supporting charging infrastructure.) The possibility of charging while loading or unloading could drive earlier adoption because it has the potential to reduce cost based on smaller battery-size requirements.

Long-haul (and partly regional) applications will require in-route charging, for example, at motorways or resting areas. On the one hand, the high level of predictability of long-haul routes allows for concentrated investment in charging infrastructure. Companies can identify key routes and charging points and prioritize them for investment. Analysis shows that on popular routes a charging point every 80 to 100 kilometers could suffice for the early phases of HDT adoption, so the sheer number of charging points might not be the limiting factor.

Nevertheless, companies have yet to overcome the technical challenges associated with rapid charging speeds that can match optimal opportunities during compulsory driver breaks. Currently, charging-infrastructure investments focus primarily on passenger cars, and they result from individual companies, OEMs, or consortia (for example, the Ultra E project) in Europe and the United States, and from the state-owned State Grid in China. While the LDT and MDT segments may leverage passenger-car charging infrastructure, major technology upgrades will be necessary to charge HDTs efficiently. For example, to charge an HDT with a battery close to 1,000 kilowatt-hours, a common supercharger (with assumed average 120 kilowatts charging capacity) would need eight hours.

Trends in eTruck supply

The wholesale switch to eTrucks remains further down the road. Today, manufacturers can achieve TCO parity between eTrucks and diesel trucks in specific applications with purpose-optimized vehicles. However, fleet operators cannot yet consider conversion toward a pure eTruck fleet due to the lack of suitable products on the market.

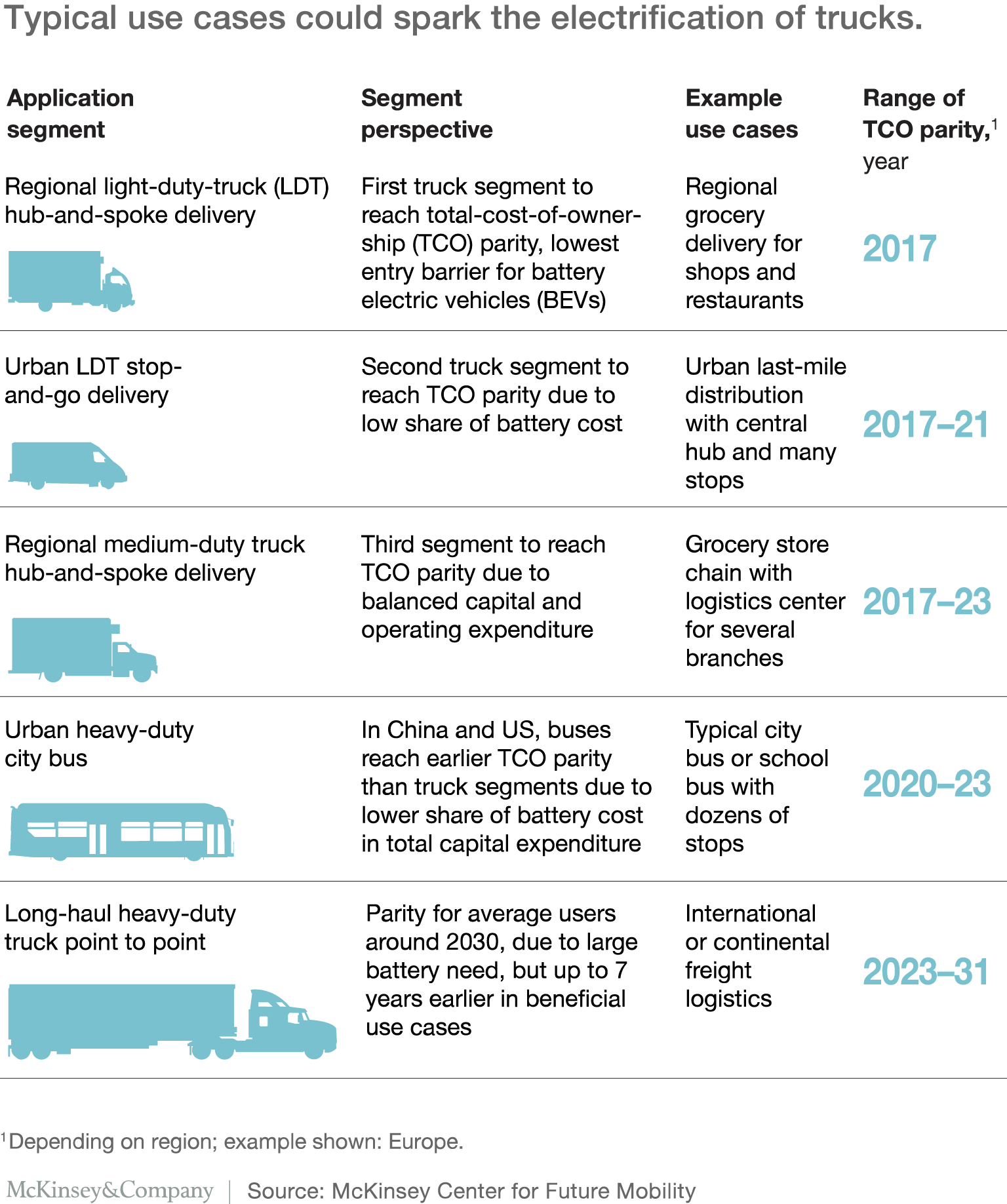

Several OEMs are developing models and investing to solve the remaining technical challenges specific to eTrucks. With development cycles and product life cycles reaching more than ten years in some segments,2 it will take some time before the industry will offer a large portfolio of eTrucks. Moreover, the LDT segment is the focus of current product-launch announcements, where the technological similarities with passenger cars are highest. Many LDT models will launch around or before 2020, with seven new LDT launches planned for 2017 and 2018, and production will increase accordingly. Interestingly, we see a growing number of model announcements in the HDT segment for which TCO parity for the average user is reached at around 2030, with beneficial use cases from 2023 (Exhibit 3). Fourteen OEMs have announced launches or have started fleet testing new HDTs and city buses since 2016, and launches are likely to grow increasingly around 2020. In contrast, economically attractive segments of MDTs have seen only a few new eTruck announcements so far. Like the HDT segment, we expect eTrucks that target MDT urban and regional use cases with limited range requirements to debut around 2020.

The potential effect of regulation on eTruck sales

Tightening emissions targets and the high likelihood of bans on diesel engines in many Chinese, European, and US urban areas should accelerate eTruck adoption. In fact, the implementation of regulation for commercial vehicles has tended to be faster than for passenger cars. For example, our analysis of the European Union revealed much quicker regulatory implementation for CVs: whereas it took passenger cars 16 years to meet new standards, CVs required only 3. Furthermore, France and the United Kingdom are already announcing their first timelines for passenger zero-emission zones.

In China, the government started to tighten HDT- and MDT-emission regulations in 2015. The industry will need to closely observe if China requires mandatory EV credits for the HDT and MDT segments and introduces stricter regulations for LDTs. Our BECV-uptake model accounts for potentially rigorous enforcement of China’s low-emission policy for commercial vehicles soon after 2025, which could guide whether the trend is toward an early-adoption or late-adoption scenario.

In the United States, national regulations will require up to a 25 percent reduction in carbon-dioxide emissions by 2027. However, this reduction alone may not drive eTruck penetration, since other technologies could also achieve these targets, such as aerodynamic improvements, low rolling-resistance tires, or improved engine efficiency.

Although carefully designed and validated with companies and experts in passenger- and commercial-vehicle electrification, these insights are just one possible outcome. Given the complexity of the projections and the many factors involved, we can adjust the market model depending on changes in the three factors.

Factors that will drive eTruck penetration in the market through 2030

McKinsey’s focus on common and specific use cases provides a transparent way for industry players to understand the forces driving BECV technology into the market.

When examining the underlying drivers of eTruck penetration, use cases can highlight patterns (such as range versus typical driving distances and charging patterns) and adoption rationales. We selected globally representative use cases that we believe will drive the adoption of electrified commercial vehicles in China, Europe, and the United States (Exhibit 3).

Five crucial use cases will likely spark commercial EV adoption

Five use cases represent a large share of BECV driving patterns. In addition to these use cases, we analyzed the potential from adjusting inputs to the very specific needs of customers. Doing so can shift TCO parity points by up to ten years in targeted subsegments.

Some of the detailed specifications and driving patterns will differ across regions. As an example, this section focuses on use cases tailored for the European market.

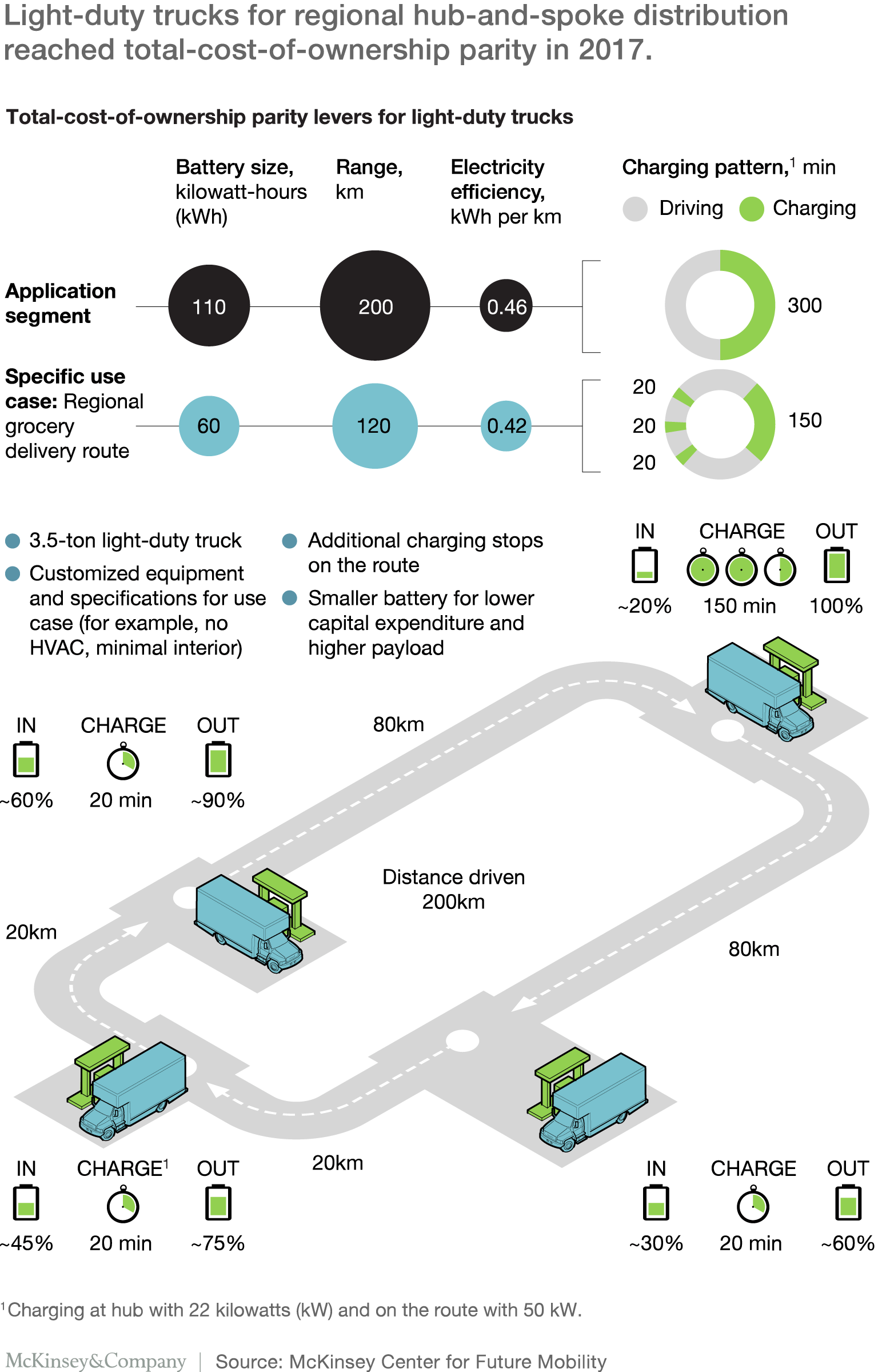

Light-duty regional hub-and-spoke delivery. This use case can reach TCO parity with diesels today. While most industry players focus on last-mile and urban-delivery solutions, the regional hub-and-spoke distribution approach is more advantageous from a TCO perspective (customers could include regional grocery delivery for shops and restaurants). Vehicles in this use case could share passenger-car components and infrastructure to accelerate adoption. However, the need for charging infrastructure at a regional level likely represents an implementation bottleneck (Exhibit 4). By opportunistically charging with an adjusted battery size during loading and unloading periods, fleets could advance the timing of TCO parity.

Light-duty urban stop-and-go delivery. This use case could break even around 2021, which recent OEM announcements reflect. Vehicles can make use of components and infrastructure originally designed for passenger cars, and the typical start–stop drive cycle does not strain the EV powertrain as much as it does a diesel. Fleets can push TCO breakeven forward by de-specifying the vehicle to fit the purpose—for example, by reducing the battery size to reach parity today. Likewise, diesel-vehicle bans or zero-emission zones in urban areas could accelerate the overall adoption of BECVs in the stop-and-go use case. With despecifying, companies could reach TCO parity today.

Medium-duty regional hub-and-spoke delivery. For this use case, TCO could break even around 2023. Nonetheless, OEM announcements do not fully reflect the full potential of the use case. Some use cases could break even today by adjusting the vehicle to specific route characteristics and by rightsizing the battery capacity by taking advantage of en-route charging opportunities.

Furthermore, PHEVs could accelerate adoption, acting as a bridging technology for specific use cases and driving patterns, such as driving in zero-emission zones or changing patterns between urban and regional routes. In such cases, PHEVs could penetrate the medium segment to enable delivery to such zero-emission zones even without TCO cost parity with ICEs (as regulation would be the key driver in this situation).

Urban heavy-duty buses. These will likely break even around 2023. Central fueling and start–stop driving cycles favor BECV technology over diesels. Furthermore, fleets could reach TCO parity earlier (in 2020) by charging the battery more frequently during daily operation. For example, certain stops could feature charging infrastructure. Urban diesel bans and zero-emission zones will also help drive adoption rates. Furthermore, city governments could choose to adopt BECV technologies before the use case breaks even on TCO because they value their low-emission profile.

Heavy-duty point-to-point long haul. The average heavy duty application reaches TCO parity only toward 2030. The need for a bigger battery initially causes a larger cost difference, yet the cost gap between diesel and BECV will decrease. Battery-induced payload loss remains, making the use case unfavorable for weight maximizers (yet some regulators may increase the maximum payload for BECVs). Counterintuitively, we expect several companies to launch HDT eTrucks long before 2030, likely driven by three reasons: First, we could see TCO parity as early as 2023 for users that optimize the benefits of BECVs—for example—by achieving higher utilization (300-plus days a year), introducing mid-day charging, and requiring below-average payload needs. (An example, could be industrial area stop-and-go goods delivery). Second, operators may want to include BECVs in their fleet to reach potential fleet emission targets and to gain a green image. Third, for similar reasons some customers will have a higher willingness to pay and thus TCO is not the primary driving factor. Another factor not included in our calculation is the potential efficiency and range improvement of platooning trucks, which will become increasingly relevant in the next decade.

Overall, eTrucks need to match ICEs not only with regard to cost, but also operational flexibility. Fleets cannot easily predefine all routes or vehicle-usage modes. For cases with major flexibility requirements, the average results probably offer a better indication of when TCO will break even.

The use cases driving the adoption of eTrucks in the United States and China are similar to those for the European Union. However, certain details differ, such as driving patterns, charging infrastructure, and economics. These elements will be elaborated on in a forthcoming article.

Cost-focused commercial-vehicle owners likely to drive the eTruck shift

The opportunity to cut operating costs across a fleet of trucks in a competitive logistics sector can drive rapid action, as commercial-vehicle customers focus on cost more intensely than passenger-car owners. Furthermore, by adhering to well-defined applications, fleets can choose optimum battery sizes and thus avoid overspending on vehicles. Fleets usually adopt more efficient and consistent routes compared to consumers. The fixed routes typical of freight transport allow fleets to pursue more effective charging-point planning. Although not really a cost factor, the corporate image of an emission-free fleet could also drive adoption.

Autonomous driving has a positive impact on the TCO-per-kilometer equation for all technologies, as it can potentially eliminate a major cost element: the driver. This move also enables higher vehicle utilization and accelerates the payback time for eTrucks. The largest impact area of autonomous driving on TCO per kilometer will be on urban use cases for light vehicles, where driver costs account for the largest share of operating costs.

Our research suggests that electricity supply (from a generation perspective) in leading economies can cope with the additional demand posed by eTrucks in off-peak times, which remains below 1 percent of total electricity consumption by 2030. Challenges could potentially arise during peak periods, when load volumes occur. Furthermore, additional local grid upgrades are required in areas with supercharging stations for medium and heavy eTrucks.

Key success factors for the eTruck ecosystem

We believe stakeholders of the eTruck ecosystem should work together to respond on the upcoming demand for use-case-specific electric powertrains and address topics such as infrastructure needs (that is, coverage and standardization) and specific customer requirements.

OEMs can take several steps to better position themselves for success in this rapidly changing industry. For example:

- Design to specific use cases. Despite average TCO parity after 2025 in most segments, innovators are already targeting specific use cases with tailored products that can shift TCO parity forward by a couple years or that break even today. Players interested in playing a significant role in the eTruck market should push for having technical solutions ready soon to position themselves as innovators.

- Innovate the business model around eTrucks. The eTruck business can be substantially different than today’s “regular” ICE truck business. Whereas today the ICE truck is seen as hardware with potentially selected “on-top” services, the eTruck business model will likely introduce a holistic service concept, including the required charging infrastructure and power contracts. The pricing approach will shift from uniform pricing across customer segments to value-based pricing for optimal exploitation of the specific willingness-to-pay per customer segment. While today fleet and owner operators buy or lease trucks, the future eTruck business model can rely on usage-based delivery models, providing delivery-mobility to the end customer instead of hardware.

- Master supply chain (for example, tier-one suppliers) and operations. The entire supply and value chains must cope successfully with the shift to electrified powertrains. More than 80 percent of the e-powertrain could come from nontraditional tier-one suppliers.

- Capture supply chain synergies. Integrated passenger-car and truck OEMs could capture a competitive benefit due to the opportunity to scale up technological and cost advantages. For example, LDT BECVs can benefit from developments in passenger-car EVs, which might share common components. Furthermore, integrated OEMs may enjoy greater scale effects on batteries or electric motors.

- Educate, train, and enable the dealer network and the customer. OEMs should enable their entire ecosystems in the handling of the new technology and educate customers regarding the reliability, durability, and design and service characteristics of eTrucks.

- Develop new selling and service competencies. Training dealership and aftersales personnel in new technologies, selling approaches, customer-handling techniques, and service typically represents a huge effort. While this transition is an opportunity for OEMs, success will require investments in both human capital and competencies.