By Pia Brüggemann, Tanguy Catlin, Jonas Chinczewski, Johannes-Tobias Lorenz, and Samantha Prymak.

The insurance industry is in the midst of a radical, digitally infused shake-up. Customers are embracing digital channels, and technologies such as the connected car, smart home solutions, and artificial intelligence (AI) have ushered in an era of new products built on data and analytics. Attackers—insurers with pure-play digital business models, such as Lemonade in the United States, Youse in Latin America, or Nexible in Europe—are using digital applications such as chatbots to turn the process of buying a policy or filing a claim into a fast, simple, and satisfying experience. This approach is a far cry from the analog, and often frustrating, processes of traditional insurers.

With new attackers on the hunt for customers, incumbents must move quickly to integrate digital technologies into their operations. For the property and casualty (P&C) industry, digitizing the claims function holds tremendous potential. To capture the value of digital,1 P&C claims functions must embark on a transformation to become a customer-centric, digitally enabled organization that excels in the three foundational areas of claims—customer experience, efficiency, and effectiveness. In our experience, a digital claims function can boost performance on all three KPIs and generate significant value (Exhibit 1).

So where to start? A true digital redesign of claims integrates a relentless focus on the customer with a value-driven approach. Insurers should adopt a customer-centric mind-set and undertake an end-to-end reassessment of their customer interactions—starting with the most relevant customer journeys (see sidebar “The claims customer journey”). For maximum impact, claims functions should develop a digital value proposition and an aspirational future state for a digital claims function first and then prioritize into a transformation road map. This article examines the five essential elements needed to digitize and transform claims.

Elements of a successful digital claims transformation

In our experience, successful digital transformations in claims begin with developing a new value proposition that sets a high-level aspiration and pursuing an end-to-end digitization of the claims customer journey.2 The development of a truly innovative customer journey can be achieved by integrating with three other areas—AI and digital technologies, the digital integration of the claims ecosystem, and a new digital operating model (Exhibit 2). Together, these five elements give management the strategy and tools to both transform claims into a digital function and improve performance on all of the three foundational KPIs.

New digital value proposition for claims

For the digital age, the claims value proposition—that is, the value an insurer can provide to its customers through the claims process—needs to go beyond traditional after-the-fact claims management. The value proposition sets the aspirational goal of offering excellent omnichannel customer experience supported by intuitive digital processes. Insurers should aim to adopt a faster, analytics-driven approach to claims handling and fully automate the claims handling processes for clear and simple cases. For example, Lemonade has worked to redefine the customer experience with an innovative, chatbot-based FNOL system that creates automated claims payouts within seconds.3 In addition to working actively with customers to prevent claims, insurers should provide services that add value for and delight customers and draw on customer feedback to continually improve service offerings, usability, and performance.

Instilling this upgraded value proposition within the organization is an often-underestimated element of a digital transformation. Top and middle management in claims should become champions for the new value proposition; otherwise, they risk finding themselves halfway through the digital transformation without the necessary company-wide buy-in to stay the course.

End-to-end digitization of the claims customer journey

At the core of the claim function’s digital transformation is a redesign of the claims customer journey. There is no silver bullet interaction that ensures customer satisfaction, but a successful redesign typically involves considering processes from the customer perspective and optimizing back-office processes accordingly to provide simple and fast claims services.

Insurers should start with an “everything is possible” mind-set to unleash truly transformative ideas. Satisfaction surveys in claims consistently show that customers desire a fast and intuitive process as well as transparency on where they are in the process and what happens next. Accordingly, the digital redesign of a claims journey needs to go much deeper than superficial process improvements. Adeslas, a Spanish company, has worked to complete an end-to-end digitization of their claims journey, implementing features such as multichannel FNOL, automated claims segmentation, and digital claims status tracking.

To determine how digital technologies can unlock value and improve the claims customer journey from start to finish, managers should examine each step of the journey with the following areas in mind and start to develop an aspirational future state for claims that is unconstrained by potential short-term, technological barriers:

Product simplification

Customers want simple and fast digital interactions, but complex coverage details that include many specific exceptions can create barriers. Large numbers of legacy products with different coverage details also make it difficult to implement and maintain the technology systems necessary to improve efficiency. A carrier should find ways to simplify products and reduce product generations to ease the development of fully digital customer journeys.

Customer and intermediary self-service

Insurers have the opportunity to shift simple, routine transactions from claims handlers to intermediaries, such as agents and brokers, or customers themselves. Examples include an intuitive online tool for FNOL and an online self-scheduling tool for claims adjuster appointments. As with any self-service tool, insurers must precisely define the necessary information, for example, where the customer can find his or her policy number. They must also build in support in case customers need it, such as online-chat with a claims handler or easy-to-find FAQs. Further, seamless handoffs across channels are critical: customers who start their journey online but want to talk to a claims handler or agent halfway through should be able to do so without having to repeat steps or information. This functionality requires that all system interfaces follow an identical structure and logic.

Intelligent case management

After FNOL and throughout the process, handlers typically evaluate claims cases manually to decide on appropriate next steps, such as scheduling an adjuster appointment or providing information about direct repair programs with local repair shops. Supporting the entire journey with automated, intelligent case management is critical to establishing truly end-to-end digital customer journeys. With the help of AI, a digital evaluation automatically identifies the best next step in a specific customer journey, reduces manual touchpoints, and significantly speeds up the claims process. For example, in a simple claim, this technology can allow a customer to schedule an appointment with a repair shop as part of the FNOL. Enriching these journeys with insights from behavioral economics can help customers to follow the the most satisfying and efficient paths in their claims journeys.

Frontline and back-office process digitization

Claims handlers and adjusters manually carry out often-complex tasks, leading to significantly divergent results. Digital tools and systems can simplify and standardize manual processes. For example, tablet-based calculation tools for home damages can help claims adjusters estimate the value of losses faster and more accurately and consistently—even if this means that indemnity payments may increase for certain cases. Standardized reports and calculation methods will leave customers with a comprehensive overview of how their claim was calculated. This results in higher customer satisfaction and a leaner process with reduced follow-ups and recalculations or litigation.

Back-office automation

Insurers can achieve the greatest efficiency gains by fully automating back-office processes. Customers benefit significantly from faster claims processing—for instance, through automated verification of car repair estimates and invoices as well as automatic reimbursements as soon as the repair invoice has been verified. In addition, digital tools can support and assist the decisions of claims handlers, leading to better outcomes.

Communication

Providing customers with the necessary information in digital channels offers customers the sense of control they desire. The quality of communication can raise customer awareness and usage of digital self-service tools throughout their journey. One US insurer, for example, implemented a digital case-tracking tool and reduced the number of status request calls by more than 50 percent.

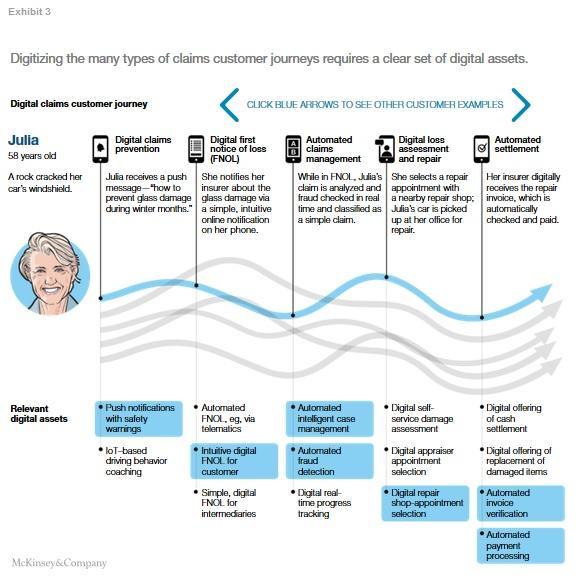

By examining each of these areas, claims functions can start to rethink the claims customer journey and back-office processes. This approach should be synthesized into an aspirational future state outlining the digital assets needed to achieve the ideal state (Exhibit 3). Claims leaders should prioritize these digital assets based on the value they can generate. For example, digitizing invoice reviews and automating payment processing often significantly reduces processing time.

Exhibit 3: click here to see other customer examples.

Enabling truly innovative customer journeys

Offering truly innovative customer journeys requires a combination of AI and upgrades to technology platforms as well as the digital integration of partners in the claims industry ecosystem. A greater understanding of these elements and the digital operating model needed to bring them to life can help claims managers make the proper investments.

Digital customer journeys require not only the AI-enabled automation of decisions traditionally made by claims handlers but also an IT architecture that supports real-time digital interactions with customers (see sidebar “Defining AI”). While AI should ideally support the entire customer journey, it can generate significant value by automating claims management. Ageas UK, for instance, is working with Tractable to integrate the latest AI and picture recognition applications to segment claims cases in real time.4 The following three modules lay the basis for real-time engagement:

Prediction of claims characteristics

AI can help infer as-yet-unknown characteristics of a claim, such as the likelihood of fraud, total loss, or litigation, to speed up its downstream handling. A European insurance carrier, for example, significantly improved its fraud detection accuracy implementing an AI-based fraud detection system resulting in an 18 percent increase in fraud prevention as well as productivity gains in fraud investigation. And leading players in automotive can estimate a vehicle’s damage value in real time at FNOL based on customer pictures or a damage description, using the latest advances in AI and picture recognition.

Claims segmentation

AI algorithms can help segment claims cases by complexity using factual and predicted claims characteristics. Based on this segmentation, claims can be assigned to specific downstream handling processes—either one of the fully digital self-service journeys (such as selecting a direct repair shop in self-service) or a claims handler for more complex cases (for example, with high litigation risk).

Supported claims handling

Going beyond the first two modules, AI can support in finding the optimal claims handling process for a specific claim: A global insurance carrier, for example, leveraged AI to derive business rules to identify clear and simple claims cases suitable for an automated process. An Italian insurance carrier is even going further and developed a “best-match” routing approach to find the best-experienced claims handler for a specific case and this way significantly improves its claims handling accuracy (Exhibit 4).5

Integrating real-time customer interactions and insights from AI modules into customer journeys poses vastly different requirements for the IT architecture. While in the past, online interactions with the customer were only one way (for example, saving the details of an online FNOL into the claims database), interactive digital customer journeys require real-time, bidirectional interactions. A new IT architecture concept—generally referred to as two-speed architecture—is required to complement the stability of the core claims database with responsive features on the front end. A middle layer connects the traditional, slow claims database with customer-facing interfaces and runs AI modules. This functionality connects the information a user submits with insights from AI in real time to populate online forms and offer direct feedback to the customer.

Digital integration of the claims ecosystem

For competitive differentiation and ownership of the customer in a claims case, insurance carriers need to proactively manage more (ideally all) processes related to a customer’s claim—also those involving third parties. For example, the German claims solution provider Control€xpert digitally integrates with insurance carriers and repair shops to automate its invoice-verification process. Other providers offer appointment scheduling with repair shops and rental car companies. By providing a fully integrated digital experience, claims functions can become the true and sole owners of customer contact in a claims case.

To combine such offers into efficient, digital, self-service journeys, insurance carriers need to digitally integrate with relevant players in the larger claims ecosystem (Exhibit 5). In addition, a digital integration can vastly improve efficiency in communication between the ecosystem parties and speed the claims processing for the customer. As this type of digital integration is currently rare, a carrier can become the ecosystem integrator, harnessing the best of the ecosystem for its customers.

Given the complexity of this integration, carriers should prioritize pursuing digital interfaces with the players that are involved in a high number of claims cases. In auto insurance, for example, these players would be roadside assistance services, claims assessors, and repair-shop networks, as well as invoice control service providers. Insurers don’t need to start from zero. In many markets, insurtechs have started to lead the digital integration, for example, by digitally connecting car repair shops and enabling digital cost-estimate and invoice transmission. Insurers should explore partnerships with existing offerings to further digitize and integrate the claims ecosystem.

New operating model for the digital age

A successful digital transformation radically reinvents the claims customer journey with the help of AI, digital technologies, and the claims ecosystem. To support these efforts, the claims department needs to pursue deep, cross-functional collaboration with other functions such as marketing and IT. Bringing the transformation to life requires new roles, including data scientists, customer journey “owners,” and user experience designers, as well as a digital way of working, which must be instilled in the organization. This approach involves learning by doing, which takes time to implement but can be jump-started in the following ways:

- The digitization of each customer journey should start with a short design phase. Ideally, design thinking techniques are used to iteratively develop the best possible end-to-end customer journey. This process directly integrates consumer feedback on ideas and concepts.

- Successful players quickly move from the drawing board to prototype development. Progress is best made with agile development methods, such as creating and improving a minimal viable product in ten-day intervals and then quickly evolving the prototype. Early customer testing and the resulting feedback are continually incorporated into the development of digital channels and solutions to ensure the customer’s experience of the evolving digital claims journey continually surpasses expectation.

As this new approach can represent a substantial change, success depends on deeply integrating a digital way of working into the entire organization. For example, Allianz’s Global Digital Factory launched a digital delivery hub to achieve change through digital projects, such as developing claims solutions, across its international operations. Successful organizations tap joint cross-functional management teams to lead the effort, develop experts in all digital methods, and provide intensive coaching for all relevant employees.

Purely digital industry attackers have raised the bar for performance by showcasing simple and intuitive customer interfaces, making it imperative for incumbent carriers to radically redesign their claims customer journeys. Those insurers that move swiftly and decisively to transform the claims function can equip themselves to deliver against the new, higher customer expectations—while increasing efficiency and improving claims handling accuracy in the process.