It wasn’t what you’d call a profound observation, but the gears in Davies’ head began turning.

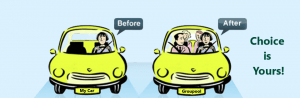

What if it was possible for other people to use these idle vehicles while they weren’t in use; what if those could then subsidise the owner’s on-road costs?

Car Next Door was born, and together with IT guru Dave Trumbull Davies a company has evolved that has grown in all key metrics 500 per cent in the last two years.

The car-sharing platform currently boasts a fleet of 1300 shareable cars available to 50,000 members.

With wheels on the ground in Sydney, Melbourne and Brisbane, Car Next Door has successfully completed over 100,000 bookings and has plans to go nationwide in 2018.

As pleased as he is with Car Next Door’s stratospheric growth, Davies said the true goal of the business is to radically disrupt the “traditional” way of owning and running a vehicle.

“The current model of car ownership is crazy – it’s costly and wasteful. Car Next Door started as a common-sense solution to the waste caused by millions of cars sitting doing nothing all day,” Davies told 9Finance.

“It helps ordinary people cut down on the huge expense of owning a car. It costs a two-car family something like $22,000 a year to get around, that’s a big outgoing on the yearly budget.”

In practical terms, the way it works is simple: a user keen to borrow a car signs up to Car Next Door’s website to be approved, and once they are given the green light they can choose and book an available car.

Once a car is found, there’s no need for awkward chit-chat with the owner (who’s probably at work) because the vehicle’s keys are in a waterproof digital safe that hangs over one of the rear windows.

Having any old punter off the street drive around your pride and joy sounds like a disaster for most automotive purists, but Davies said they’ve ironed out all the bugs around lending cars to terrible drivers.

“Central to our success is a strict membership criteria, an easy to use online booking and payment system, insurance and high end, in-vehicle technology to make the transaction safe, fast, and hassle-free for both owners and borrowers,” Davies said.

“We’ve got comprehensive insurance that covers anyone driving the car and strict standards that both the car owners and the car borrowers have to meet to become members, and if they don’t stick to the rules then they’re out.”

Unlike other businesses in the share economy that have you delivering food by bike or using your car as a faux taxi, Davies said most car owners aren’t on Car Next Door with dollar signs in their eyes.

“Most people aren’t in this to make squillions – they are paying high fixed costs each year to register, insure, finance and maintain a car, so it makes sense to offset those costs by renting it out when they’re not using it,” he said.

“The average earnings for a car owner is around $3500 a year, but people who are really looking to make a profit will put vans on the platform – some people are earning upwards of $10,000 a year that way.”

Ten years ago such a business would’ve fallen at every step – from finding a place to securely keep the keys to the filling out of insurance documents – the obstacles were simply too many.

But as Australians, and in particular the inner-city residents of Sydney and Melbourne, warm to the idea of the share-economy it seems there’s little to slow the progress of Car Next Door.

“Cars are used for less than 5 percent of the day, on average,” Davies said.

“Fewer young people are wanting to invest in cars – they’re more interested in mobility on demand.

“Developments like ride-share apps, traditional and emerging forms of car sharing and, eventually, the evolution of driverless vehicles will see the market for personal transport changing in the coming years.”